INTRODUCING

The software solution for investor reporting & account reconciliation

Q

ABOUT Q

Q is a fully integrated, cloud-based platform that combines innovative technology and subject-matter expertise into a powerful Exception Management, Research, and Reconciliation system. By leveraging extensive data analysis, Q automates portfolio balancing and reconciliation with great precision and speed. Coupled with dynamic, yet structured decision paths, Q provides extensive insight into loan accounting practices and is an invaluable asset for any Loan Servicing team.

✓ Reduce operating costs and book losses

✓ Proactively mitigate risk and exposure

✓ Showcase audit and compliance results

✓ Elevate to the top of your GSE peer group ranking

✓ Reduce exceptions and stabilize your portfolio

✓ Eliminate stand-alone tools and spreadsheet errors

TECH SPECS

Learn More About Q Modules & Features

Features

Dynamic, Flexible, Powerful

Servicer and Investor Data

Includes 200+ servicer reports and 50+ investor reports in a single data repository for easy viewing and download access.

Permanent Remediation

Our exception-based approach not only identifies, researches and resolves servicer-investor differences but also facilitates permanent remediation of root causes.

Portfolio Balancing

Q provides rapid and precise auto portfolio balancing to eliminate unintentional errors from VLOOKUPs.

Integrated Modules

Seamless data, sophisticated algorithms and metadata are incorporated throughout investor reporting, account reconciliation, and loan sales & transfer modules.

Predictive Analytics

Avoid servicer-investor differences by adjusting before exceptions occur and quantify trends produced by upstream servicing errors.

Secure and Accessible

Secure by design, our cloud based technology is scalable and available any time.

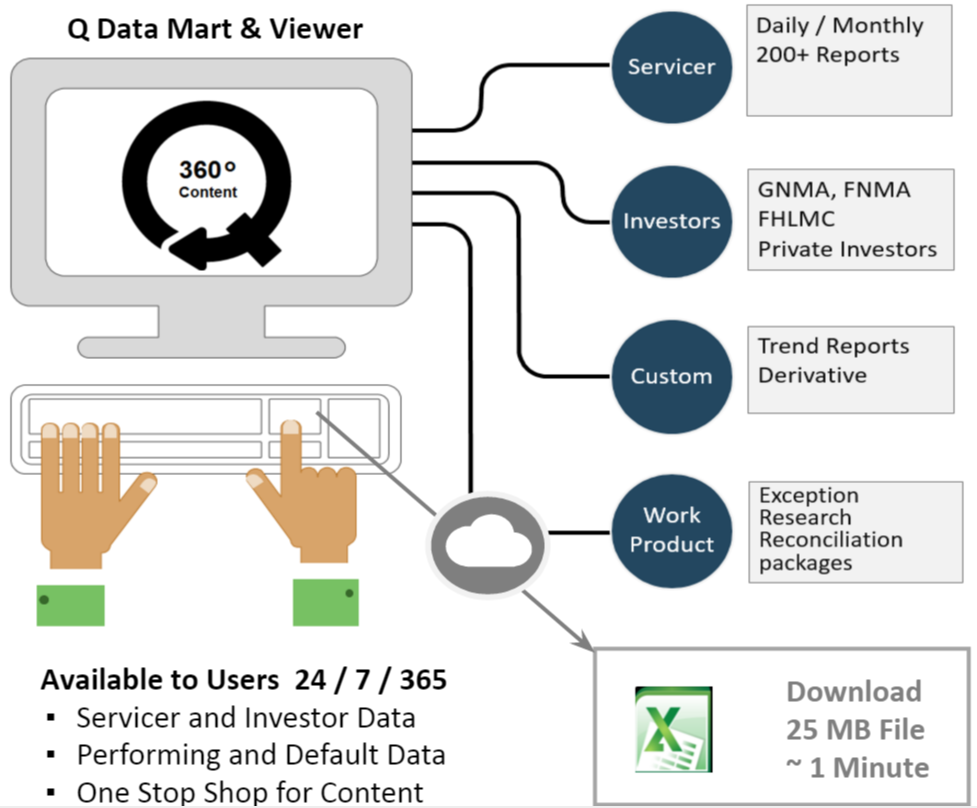

Data Mart

Data at Your Fingertips

Features

Data Mart is a central repository for both servicer and investor data, readily available in a consistent excel format. Access 250+ unique reports spanning servicing, collections, loss mitigation, default, REO & corp advance.

Benefits

It provides effortless 360° content repository for the majority of surveillance and analysis needs.

Investor and Servicer Reports

Includes 200+ servicer reports and 50+ investor reports in a single data repository with sophisticated ETL functionality.

Easy to Search and Organize

Easily searched in a filterable web based grid that is segregated by investor type (ALL, FNMA, GNMA, FHLMC, Asset & Private).

Automated and Accurate

Rigorous validation procedures for all reports with daily automated loading, validation and monitoring.

Download Every Report

Download functionality is available for every report in a consistent Excel format.

Maximum Security Measures

Highly secure by design: scrubbed daily for sensitive data, row level security on all reports and contains no customer NPPI.

Always Accessible

Cloud based data that is accessible 24 / 7 / 365 and hosted on an industry leading data center.

Information is Power

Let us provide the data to maximize your success

✓ Complete

✓ Consistent

✓ Readily Available

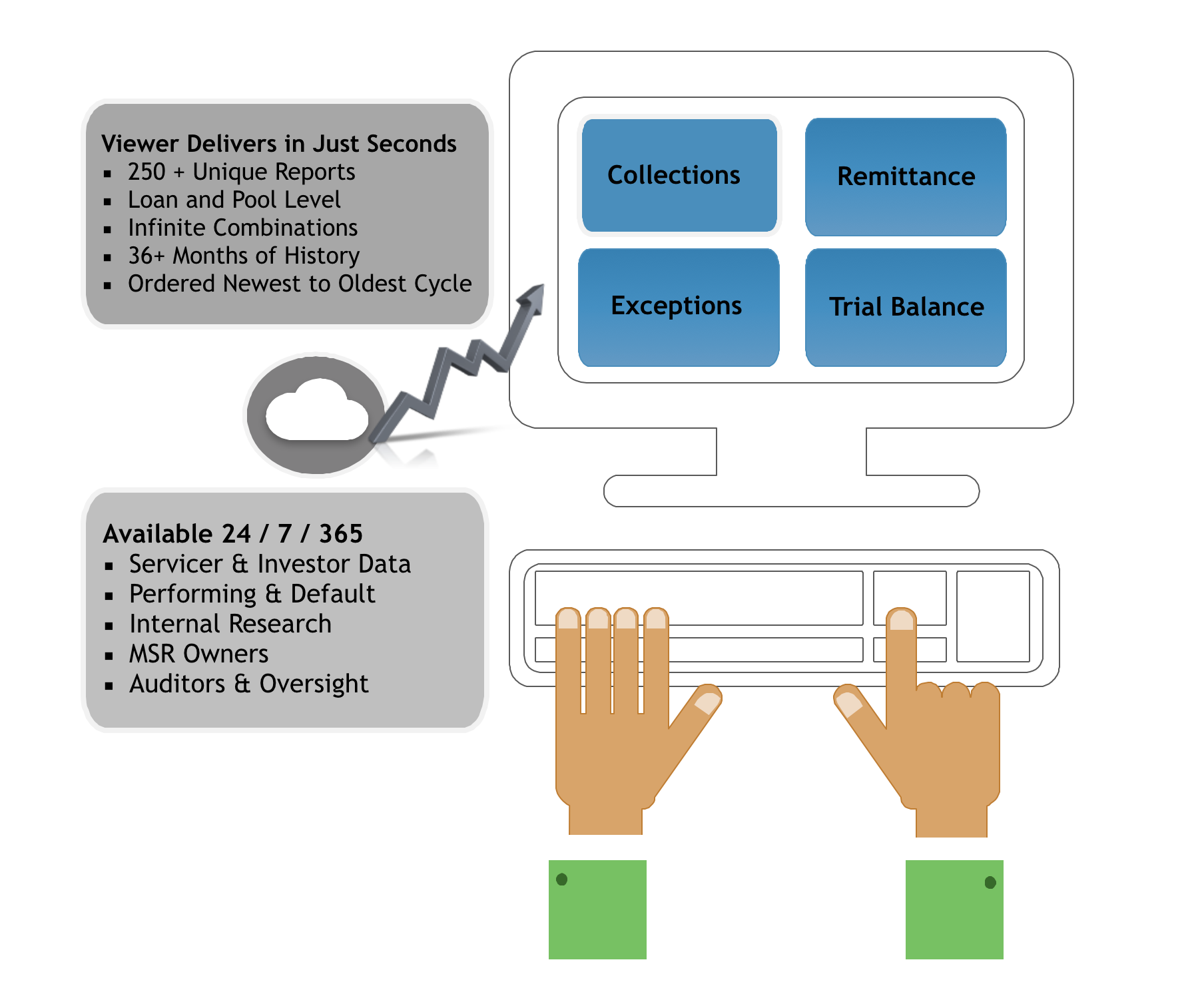

Viewer

Research Made Easy

Features

Leverage your servicing and investor data with our integrated research tool. Q Viewer is the central point of access for Servicer, MSR owner, and Auditor for loan and pool research. This powerful tool allows you to create an infinite combination of reports with multiple cycles viewable from a single portal.

Benefits

Viewer makes it easy to handle an unlimited number of pages, tabs, and report combinations for faster situational research and more comprehensive results. Eliminate the traditional report aggregation process and resulting errors, enhance the user experience, permit more in-depth research and accelerate resolution.

Pages

Create any number of pages and link them directly to work queue filters so they are immediately available for specific research purposes.

Tabs

Within each page add any number of tabs for easy viewing of additional content.

Reports

Select and display 250+ servicer, investor and PMSI reports on any tab with information from each cut-off cycle consistently organized from newest to oldest.

Loan Sales & Transfers

Minimize Transition Errors

Features

Benefits

The best way to minimize Investor / Servicer system, data and cash differences is to avoid them. PMSI has built significant logic, automation and error identification around the time consuming and tedious processes associated with Loan Sales and Loan Transfers.

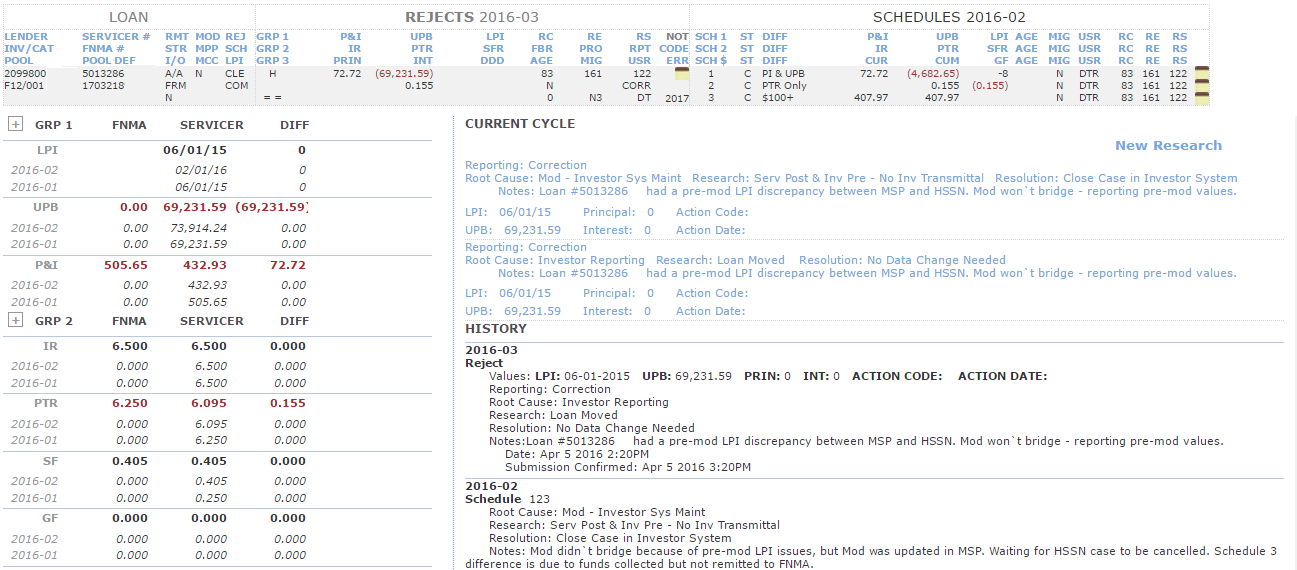

Investor Reporting

Utilized by FNMA, FHLMC and GNMA #1 Ranked Servicers

Features

We leverage exception management as a base operating principle. All modules are constructed with work queues, work filtering capability, loan and pool data, aging, migration, historical research results and critical event metadata to perform in depth research.

Benefits

Built to dramatically improve efficiency and accuracy of research to permanently resolve Servicer – Investor differences that lead to unnecessary charge-offs, off balance sheet liability and reputation risk.

Exception Research Queues

Exception Detail Pages

Portfolio Reconciliation

Unsurpassed Speed & Precision

Features

Through extensive analytics and modeling, PMSI has harnessed both the Investor and Servicer Trial Balances, including numerous additional reports, to perform highly automated and accurate portfolio data comparisons. Taking it a step further, we have automated 100% of the balancing and over 85% of the research in FNMA’s Required Schedules 1, 2 and 3.

Benefits

Investor required portfolio reconciliations may seem to be an intrusive burden on a servicer; however, with the benefit of advanced automation the requirement becomes a simple task. PMSI’s system permits routine monthly execution of critical portfolio data compares, research and adjustments all within cycle, minimizing exceptions and cash differences.

FHLMC Reconciliations

Last Paid Installment Date

Unpaid Principal Balance

Annualized Net Yield

Active / Inactive Status and Dates

Deferred Principal Balance

FNMA Reconciliations

Mortgage Portfolio Reconciliation

(Form 473, Schedule 1)

Interest Rate/Pass-Through Rate Reconciliation

(Form 473A, Schedule 2)

Shortage/Surplus Reconciliation

(Form 472, Schedule 3)

GNMA Reconciliations

Servicing System to GNMA 11710D

System Remittance to GNMA Pre-Collection Report

Pool To Security (Fund/Recover)

(Beta Released)

Account Reconciliation

Industry Leading Precision

Features

Embedded workflow, multi file format backup attachments, preparation and approval status dashboard with over 95% auto completed; 100% possible with electronic bank balance feed. System Generated, Loan Level, Current & Cumulative Variance, Includes TOEPI, Collections and Remittance.

Benefits

We find the needle in the haystack for you, allowing you to quantify and trend the financial impact of monthly Charge Offs and Write Offs due to upstream servicing practices.